About us

Investisseurs & Partenaires (I&P) is an impact investing group dedicated to small and medium enterprises in Sub-Saharan Africa, striving to contribute to a sustainable and inclusive growth on the African continent.

1. History & Organisation

I&P was created in 2002 by Patrice Hoppenot, former co-founder of BC Partners and expert in private equity issues. After his retirement in 2011, Jean-Michel Severino, previously CEO of Agence Française de Développement (2001-2010) and Vice-President of the World Bank for Asia (1996-2000), took over the management of the company. I&P currently employs about 20 people, based in Paris and six African local offices (Burkina Faso, Cameroon, Ghana, Ivory Coast, Madagascar and Senegal)

I&P’s mission is to contribute to the rise of a sustainable and dynamic private sector in Sub-Saharan Africa. Since its inception, I&P has invested in more than 50 companies in 15 African countries. This has generated the creation or maintenance of more than 2,600 jobs, as well as annual growth rates of 24% in the investee companies.

Our organisation

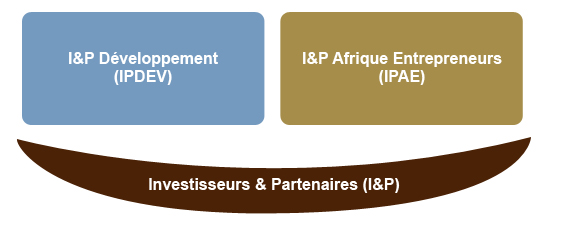

I&P manages two investment vehicles, covering financing needs ranging from 300,000 to 1,5 million euros.

- The financial company I&P Développement (IPDEV), divided into two vehicles IPDEV1 and IPDEV2

- The investment fund I&P Afrique Entrepreneurs (IPAE), managed by I&P Gestion.

2. Vision & Values

I&P’s set of values is the base of its strong corporate culture. These values guide the teams every day, in France and in Africa. They are also a feature of I&P’s relationships with all stakeholders: investors, entrepreneurs, partners and friends…

Vision

We believe that Small and Medium Enterprises (SMEs) are key to growth and development in Africa, as they create jobs, value addition and also generate positive social, environmental and governance impacts.

Mission

Build trustful long-term partnerships with African entrepreneurs while providing them with financial, strategic and operational support on one hand, and environmental, social and governance guidance/advice on the other.

Our values

Entrepreneurial Spirit: Innovation and pragmatism are at the heart of our approach, to support the growth of the investee companies and to manage day-to-day projects.

Commitment to development: I&P pays particular attention to the promoters and their vision for society, convinced that African entrepreneurs actively contribute to a more responsible and evenly distributed growth in Africa.

High Standards: This value is essential for our investors as it is a guarantee for the quality of the management and economic efficiency of our investments. It is a key success factor for our projects.

Integrity: This value is essential for implementing trustful relationships with the investors, entrepreneurs and all of the communities. The integrity of I&P’s teams is one of its key action principles in the field.

These values are detailed in a Code of Ethics, signed by all team members.

I&P’s carbon footprinting’s strategy

In alignment with its ESG strategy / as to apply internally the best ESG practices, I&P is committed to calculate and reduce its environment footprint. The carbon neutrality of our offices and transportation is a key objective. To this purpose we compensate for emissions we cannot reduce through the financing of carbon projects.

In 2012, our carbon emissions represent 170 tons of CO2 eq. Indirect emissions from plane travels account for 90% of our total carbon footprint: travelling remains at the core of our activity despite the set-up of local offices in Africa to reduce long distance journeys. We offset our carbon emission with an Eco act project based in Bamako (Mali). The project consist in replacing traditional cook stoves with new energy-efficient cook stoves, offering lower wood consumption and less harmful smoke emissions.

Find out more: I&P’s Carbon Diagnose 2011

3. Our model: the partnership wheel

I&P is an active partner bringing its skills in strategy, management and finance with an entrepreneurial approach. Our model hinges entirely upon the entrepreneur, with whom we wish to establish a long-term relationship based on trust and sincerity.

I&P's investment in a business is three-fold, as symbolized by the Partnership Wheel

(1) Financing: through an equity investment, preferably as minority shareholder or through participative loans.

(2) Mentoring

- Before the investment: we conduct a thorough analysis of the company and of the strategy to be implemented

- During the investment period: we are actively involved in helping the implementation of this strategy and putting in place management tools developed in partnership with the entrepreneur

(3) Technical Assistance: capacity building and training in a variety of fields based on the investee business specific needs: management information system, industrial/technological, sales/marketing, organization/HR, training/governance, etc.

OUR MODEL: THE PARTNERSHIP WHEEL

Find out more about our Financial Vehicles and Investment process.

4. Corporate governance

I&P Développement

Investment decisions are made by the IPDEV board of directors. This boards meets once or twice quarterly to discuss and analyse the ongoing projects.

The board is chaired since June 2012 by Olivier Lafourcade.

Olivier Lafourcade is a member of the board of directors and investment committee of IPDEV since 2004. In June 2012 he becomes chairman of this board.Olivier Lafourcarde spent most of his career at the World Bank, which he joined in 1973, accumulating considerable operational experience in many countries, in particular in Africa, Asia and Latin America. His latest position at the World Bank was as Director for Mexico, Colombia and Venezuela, with residence in Mexico City from 1996 to 2002. Previously, he was appointed Director in several countries in West and Central Africa. For the last 10 years, Olivier Lafourcade has been an international consultant in the field of economic development collaborating with many public and private institutions, NGO’s and universities interested in international development. Olivier Lafourcade, is a graduate of the Ecole Nationale Supérieure Agronomique of Rennes (France), and he holds an MSc and a PhD degree in Agricultural Economics from the University of Maryland (USA). In addition he is a graduate of the Stanford Executive Program (1997).

Olivier Lafourcade is a member of the board of directors and investment committee of IPDEV since 2004. In June 2012 he becomes chairman of this board.Olivier Lafourcarde spent most of his career at the World Bank, which he joined in 1973, accumulating considerable operational experience in many countries, in particular in Africa, Asia and Latin America. His latest position at the World Bank was as Director for Mexico, Colombia and Venezuela, with residence in Mexico City from 1996 to 2002. Previously, he was appointed Director in several countries in West and Central Africa. For the last 10 years, Olivier Lafourcade has been an international consultant in the field of economic development collaborating with many public and private institutions, NGO’s and universities interested in international development. Olivier Lafourcade, is a graduate of the Ecole Nationale Supérieure Agronomique of Rennes (France), and he holds an MSc and a PhD degree in Agricultural Economics from the University of Maryland (USA). In addition he is a graduate of the Stanford Executive Program (1997).

IPDEV 1

The advisory board, composed of several investors, meets twice a year to discuss the companies exiting the portfolio.

IPDEV 2

Several committees will be put in place as soon as IPDEV 2 enters investment stage.

I&P Afrique Entrepreneurs

IPAE is governed by 3 bodies.

1. The board of directors :

Chaired by Jean-Michel Severino, it is composed of Ms Annie Ferton, M. Mamadou Lamine Loum, M. Abdoulaye Bio Tchané, M. Olivier Lafourcade et two independant administrators M. Roshan Nathoo et M. Philippe Ledesma.

2. The investment committee of the management company, I&P Gestion.

Every month the following professionals from the private equity and the development sectors meet to discuss on ongoing projects and investment decisions.

- Antoine Delaporte, CEO of Adenia Partners

- Olivier Lafourcade, Consultant, former director at the World Bank

- Luc Rigouzzo, CEO of Améthis Finance, former CEO of Proparco

- Jean-Michel Severino, CEO of I&P and former CEO of AFD (2001-2010)

- François Wohrer, CEO of BBVA-France and former Senior Investment Officer at IFC

- A member of the I&P team

3. The advisory board

Composed of representative of key investors of the fund, it meets at least twice a year to give another perspective on potential conflicts of interest and on the funds activities.