Senior Associate

Submitted by admin on Mon, 10/20/2025 - 08:44About I&P

Investisseurs & Partenaires (I&P) is a B-Corp pioneering impact investor, committed for over 20 years to financing, supporting, and promoting entrepreneurs and SMEs who are transforming Africa, often overlooked by investors despite their immense growth and impact potential. From the outset, I&P's mission has been to ‘go where others do not go’.

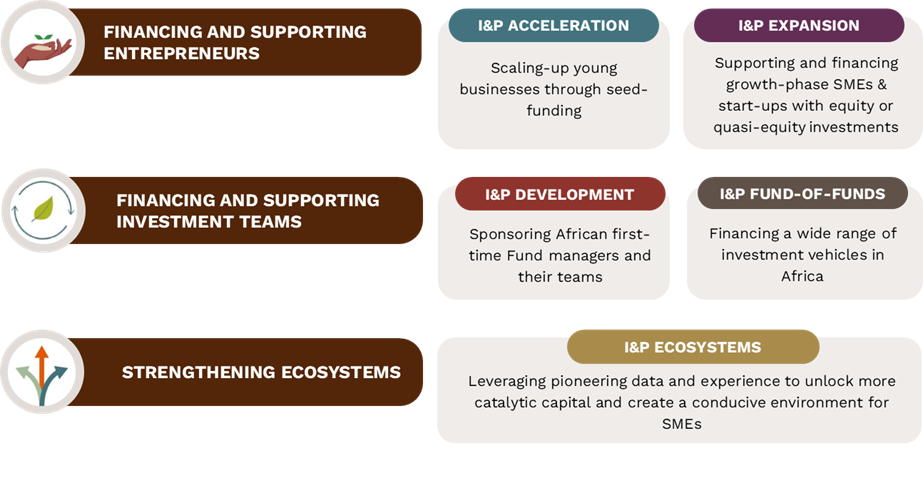

I&P's activities are structured around three key pillars to facilitate access to financing for African entrepreneurs: directly financing and supporting entrepreneurs (seed funding, private equity), launching and investing in African fund managers, and strengthening the entrepreneurial ecosystem.

About I&P Ecosystems

I&P Ecosystems leverages I&P’s data and lessons learned in SME and SME funds investing to produce insights, trainings and research rooted in practice and experience. Collaborating closely with private and public actors supporting entrepreneurship (investment funds, incubators, accelerators, public institutions, international donors, etc.), our work revolves around four activities:

- Advisory and product design - we advise public and private players on the development of financing solutions for SMEs (innovative instruments, entrepreneurship support plans, LP engagement etc.). As of 2025, we have designed more than 10 funds across African markets

- Capacity-building - we support ecosystem players with training (investment readiness, ESG-Impact etc.) and individual monitoring (governance structuring, operations, growth) to develop sustainable paths to scale. As of 2025, we have trained directly more than 800 beneficiaries and 35+ ESOs in 25 African countries;

- Learning - we generate evidence-based insights and showcase innovative best practices in SME investing. Our proprietary dataset on African emerging fund managers is unique;

- Advocacy - we leverage our learning findings to generate interest of new LPs allocating more capital in Africa and foster alignment within the impact investing ecosystem. Our advocacy agenda has positively impacted regulatory frameworks in East and West Africa and unlocked hundreds of millions of euros in catalytic capital.

Missions

We are looking for a senior associate who will be involved in Advisory, Learning and Advocacy activities:

- Collection, aggregation, processing and analysis of primary and secondary investment data (quantitative and qualitative) on SMEs, start-ups and investment funds in African frontier markets

- Building of learning products for the ecosystem, including the design of methodological frameworks, key informant interviews, literature reviews, incorporation of data collected, writing and analysis. These products take the form of reports, studies, databases or advocacy documents.

- Analysis and diagnosis of investment ecosystems (mapping stakeholders, identifying needs and supply of capital, analysing value chains);

- Support to design of financing solutions and seed funding or support mechanisms (funds, programmes, etc.);

- Sector monitoring and contribution to internal learning via internal tools and methodologies;

In addition to operational matters, the senior associate will be expected to provide support on business development and contribute actively to the life of the team including representation during major industry gatherings and cross-team collaborations with other I&P teams.

Qualification and experience

- A master or PhD degree with a specialisation in entrepreneurship, finance, management or business strategy

- +5 years of experience in consulting, development-sector research, publishing reports on African private sector; including at least one proven contribution to a public publication/report/study or other shareable work on this topic

- Passion to address the economic and structural challenges facing the African continent and improve the financing of African SMEs, including via emerging and impact fund managers

- Based in sub-Saharan Africa, preferably in Uganda or in Côte d’Ivoire or Senegal

- Sharing I&P's values: entrepreneurial spirit, commitment to development, integrity and high standards

- Bonus: direct SME investment or fund-of-fund investment experience

Technical and personal skills

- Proficiency in Microsoft Office (advanced Excel) and in at least one other data tool (R, Power BI or Python)

- Excellent communication and writing skills in English, and ideally in French

- Strong analytical and summarising skills with critical thinking, intellectual rigour, self-starting attitude, determination to achieve set objectives

- Understanding of financial analysis in the context of African SMEs

- Ability to be a credible interlocutor with high-level external stakeholders (clients, donors, public institutions, etc.)

- Excellent interpersonal skills in a multicultural and multi-stakeholder context

- Curiosity and strong ability to adapt to a constantly changing environment

What we offer

You will be embedded into a pioneering pan-African impact investing group, with data and experience drawn from 20 years of investment and 25+ funds, and a strong track record in research and advocacy. You will contribute to the advancement of the African investment sector by designing innovative products responding to SME needs, sharing of novel data to inform the ecosystem, advocacy and thought leadership…

Please send your CV and cover letter to Marianne Vidal-Marin (ipconseil@ietp.com) with the reference ‘REC Senior Associate – I&P Ecosystems’. Shortlisted candidates will be contacted to take part in a case study to assess their suitability for the role. If you do not hear from us within four weeks of submitting your application, please assume that it has not been successful.